Setting Up Client Benefits

Set up group benefits, workers' compensation, and retirement plan information for clients with the Benefits tab in Client Details.

To access this form:

- Select .

- From Client|Change, select Client Details.

- Click the Benefits tab.

Establishing Employer Group Benefit Parameters

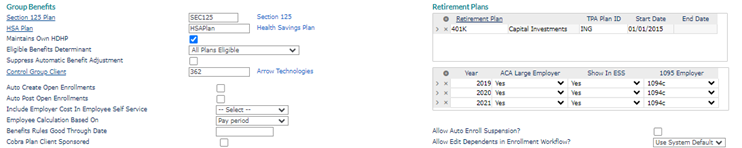

Set employer group benefit plan parameters with the Group Benefits panel.

Note: If your organization uses Benefits Enrollment, the forms for flexible spending plans display in enrollments only if the plans are set up in Benefit Plan Setup and in the Benefits tab in Client Details.

| 1. | Complete these fields as required. |

| Use this option | To define this | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Section 125 Plan | Select an existing 125 plan or type in a plan name. | ||||||||||||||||||

| HSA Plan | Select an existing HSA plan or type in a plan name. | ||||||||||||||||||

| Maintains Own HDHP |

Select if the client maintains a high deductible health plan. This suppresses the system’s validation when setting up an employee HSA.. |

||||||||||||||||||

|

Eligible Benefits Determinant |

Select to make benefits available to an employee if the client makes different sets of benefits available to their employees based on department, division, location, or benefit group. The system checks what benefits employees are eligible for based on the determinant. The Eligible Benefits Determinant field should be set to appropriate restrict eligibility to access the Eligible Benefits sections on the corresponding forms. |

||||||||||||||||||

| Suppress Automatic Benefit Adjustment | Select if the client does not want to automatically calculate benefit adjustments. | ||||||||||||||||||

|

Control Group Client |

Acts as a master company for the control group, if any. Use control groups to aggregate data when there are multiple clients that are treated as related entities for Affordable Care Act (ACA) or retirement plan reporting purposes. As an example, if an employee works 20 hours at company A and 20 hours at company B, the system treats that employee as having worked 40 hours, for the purposes of the ACA, and reports that for both companies A and B. |

||||||||||||||||||

|

Auto Create Open Enrollments |

Select to create employee web enrollment forms automatically. |

||||||||||||||||||

|

Auto Post Open Enrollments |

Select to post employee web enrollment forms automatically. |

||||||||||||||||||

|

Include Employer Cost in Employee Self-Service |

Select to Include Employer Cost in Employee Self-Service. (PrismHR Benefits Enrollment only.) |

||||||||||||||||||

|

Employee Calculation Based On |

The calculation method (Per Period, Per Month, or System Default) to use for calculating employee costs during enrollments. (PrismHR Benefits Enrollment only.) |

||||||||||||||||||

|

Disable Accelerated Catchup? |

Select one of the following options:

|

||||||||||||||||||

|

Benefit Rules Good Through Date |

An expiration date for the benefit rules set up for the client. This setting is used in the New Hire Suspension Process |

||||||||||||||||||

|

Allow Auto Enroll Suspension? |

Select to suspend auto-enrollments when an employee is hired. |

||||||||||||||||||

|

Cobra Plan Client Sponsored |

For compliance with the American Rescue Plan Act. Select if the COBRA benefit plan is sponsored by the client instead of the employer. |

||||||||||||||||||

|

Allow Edit Dependents in Enrollment Workflow? |

Allows employees to make changes to their dependents during the Onboarding process and enrollment workflow. |

| 2. | Click Save. |

Selecting a Retirement Plan

To specify a retirement plan for the client:

| 1. | Select one or more retirement plans that the client participates in from the Retirement Plans panel. |

| 2. | (Optional) Enter the TPA Plan ID for each plan if retirement plan information is reported to a third-party administrator. |

Note: Start and end dates are displayed for a plan if these dates are configured in Benefit Plan Setup.

| 3. | Click Save. |

Setting Up ACA Reporting

Indicate whether a client is considered a large employer under Affordable Care Act (ACA) guidelines for each year with The ACA Reporting table. You can also set it so employees can access information in Employee Portal (EP).

To set up ACA reporting for each year:

- Locate the ACA Reporting grid, which contains rows for each ACA year.

- Create a new row for the current year, as needed.

- Complete these fields as required.

Use this option To define this ACA Large Employer Select if the client meets the IRS definition of a large employer for that year. (The system defaults to No if nothing is selected.)

Show in ESS Select if employees are allowed to view their 1095-C information in Employee Portal (EP). (The system defaults to No if nothing is selected.)

Note: You should do this for a reporting year when you have built the registers and confirmed that the information is complete.

1095 Employer Select the information to use in the Applicable Large Employer Member fields on Form 1095-C:

• 1094c: Employer name and address from Form 1094‑C settings. • Employer Master: Employer name and address from Employer Details. - Click Save.

Setting Up Workers’ Compensation Insurance

Set workers' compensation insurance parameters with the Workers’ Compensation Insurance panel.

| 1. | Complete these fields as required. |

| Use this option | To define this | ||||||

|---|---|---|---|---|---|---|---|

| Policy |

Select an existing policy or type in a workers' compensation policy that covers the employees for a client. |

||||||

| Policy Effective Date | Set a date for a client's coverage. | ||||||

| Use Rate Templates | Select to use table-based rate templates instead of the traditional method when calculating workers’ compensation. | ||||||

|

1099 Contractors Covered |

Select if 1099 contractors are covered by the policy. Workers’ compensation calculates for 1099 employees as well as other employees. |

||||||

|

Calculation Options |

Use this option to calculate workers’ compensation accruals from the following options:

Note: Use these options only if you understand how they impact calculations. For example, the Resident State Based option works only for employees who also have the Tax Geocode Override Option option set to Override Work Geocode with Resident Geocode on the Employee Details > Other tab. |

||||||

|

Use Company/Mod Discount |

Select to use W/C accrual modifiers when calculating workers’ compensation liability for the policy. This overrides the global values set for the policy. This only affects the modifier or discount used for the accrual (cost) calculation, not the client’s workers’ compensation billing modifier/discount if this is a PEO client company. |

||||||

|

Policy Sub ID |

Use this option if the policy has a sub-ID or sub-policy identifier. This displays on the Client Details form and certain Benefits Enrollment functionality. No pricing or processing variations are allowed based on the sub-ID; it is merely a memo. |

| 2. | Click Save. |

Maintaining Enrollment Eligibility Criteria

Filter employees who are not eligible for benefits enrollment from receiving enrollment notifications and access to online enrollments with the Benefits Enrollment Eligibility Criteria panel. Filters can also exclude ineligible employees from being included in the Client Enrollment Summary Report.

If fields are left blank, the system uses client benefit rules to create an enrollment. If fields are completed, the selected parameters override the system default settings.

Note: If you override the system default settings, it is recommended to complete all fields in the panel. (PrismHR Benefits Enrollment only.)

| 1. | Complete these fields as required. |

| Use this option | To define this |

|---|---|

|

Elig Status Code |

The employee status codes that are eligible for enrollment, such as A (Active), L (Leave of Absence), and so on. Required. |

|

Elig Type Code |

The employee type codes that are eligible for enrollment, such as FT (Full-Time), PT (Part‑Time), and so on. Required. |

|

Minimum Age |

The minimum age you want to apply to benefits enrollment eligibility. |

|

Minimum Length of Service (Days) |

The minimum number of days you want to apply to benefits enrollment eligibility. The value entered must in days (for example, "30" for thirty days). |

| 2. | Click Save. |

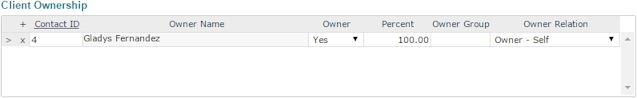

Establishing Client Ownership

Set up information about the client owners with the Client Ownership panel.

| 1. | Complete these fields as required. |

| Use this option | To define this |

|---|---|

| Contact ID |

Select a Contact ID or type in an ID for each person associated with ownership of the client. |

|

Owner Name |

Enter the name of the owner |

| Owner |

Select whether the contact is an owner (Yes or No). |

| Percent |

Set the percentage of ownership that a contact has in a client. |

| Owner Group |

(Optional): Select the group a contact belongs to. Use this only when more than one owner exists. For example, if two families own the company, enter "1" or "2" to indicate the family to which the contact belongs. |

|

Owner Relation |

Set this in conjunction with Owner Group to indicate the contact person's relationship to the owner. For example, Child of Owner. |

| 2. | Click Save. |