Creating a Manual Check

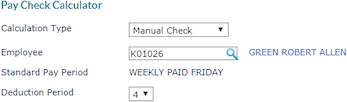

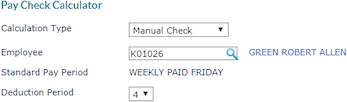

Using the Pay Check Calculator, you can enter information for a manual check that was issued to the employee. When you save, the system creates a voucher to include in the client’s next payroll batch.

Note: Before users can enter a manual check, there must be a Manual Checks Account defined in the Client Details Account tab.

|

1.

|

In the Calculation Type drop-down, select Manual Check. |

|

2.

|

Enter the Employee by either entering the name, Social Security Number, or ID to display a pop-up list of matching employee records. You can also click the field label or press Ctrl+Enter with your cursor in this field to open the search window. |

The Pay Check Calculator panel displays the employee’s ID, name, and standard pay period (pay group).

|

3.

|

Select the Deduction Period that applies to the check, if any. |

Recurring deductions for that period display in the Deductions panel after you enter hours or amounts in the Gross Pay panel.

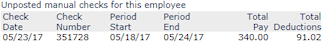

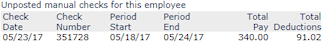

A table displays any unposted manual checks for the selected employee.

|

4.

|

The Gross Pay panel initially lists the default pay codes for the client. You can enter values in those fields, and add additional rows as needed. |

|

•

|

Select the Position the employee worked. |

|

•

|

As appropriate for the client, select the Shift or Project. (These columns are hidden if they are not specified in the Client Details > Time Sheet tab.) |

Note: The Shift and Project drop-downs display up to 1000 codes. If the code you need is not in the drop-down, click the link at the top of the column to search for the appropriate code.

|

•

|

Enter the Hours/Units to be paid. |

|

•

|

The Pay Rate defaults from the employee’s information, but you can edit it if appropriate. |

The system calculates and displays the Extended Pay.

Note: The system pulls the deductions from the employee’s Recurring Deductions record. If a new deduction is not yet included in that form, it is not listed here.

|

5.

|

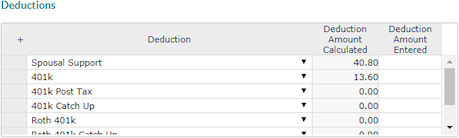

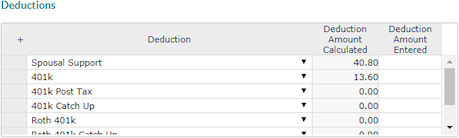

The Deductions panel lists the employee’s deductions associated with the selected Deduction Period, if any, after you enter gross pay. You can make any edits and additions as needed, otherwise continue to the next step. |

Each existing Deduction displays, as well as the Deduction Amount Calculated.

If you need to enter or edit deductions:

|

•

|

Select the Deduction, if needed. |

|

•

|

Enter an amount in Deduction Amount Entered to apply an amount for a new deduction or change the amount for an existing deduction. |

If you override the deduction amount, the Deduction Amount Calculated value changes to reflect the override amount you entered. If you edit 401(k) or Section 125 deductions, the tax amounts adjust to reflect the new sheltered earnings.

|

6.

|

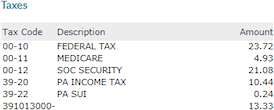

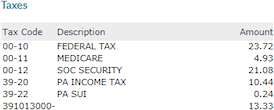

The Taxes panel displays the taxes to be deducted from the employee’s paycheck after you enter gross pay. |

|

7.

|

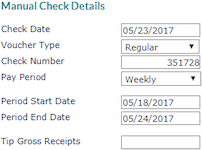

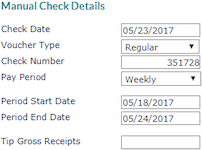

In the Manual Check Details panel, enter the necessary information. |

|

•

|

Select the Voucher Type. |

|

•

|

Enter the Check Number. |

|

•

|

Enter the Period Start Date and Period End Date. |

|

•

|

Enter the Tip Gross Receipts, if any. |

|

8.

|

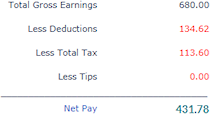

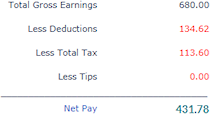

The Pay Summary panel displays the totals from the other panels and the calculated net pay. |

|

9.

|

When you are finished: |

|

•

|

To create a manual check, click Save. The system creates a new voucher and an unposted check. It notifies you of the voucher number. When the payroll processor calculates the batch, the voucher will be included. |

If there is a current payroll batch that should include the manual check you created, make sure that the payroll has not already been calculated (initialized). If it has, you need to recalculate the batch to have it include the manual check.

When your organization posts the batch, the voucher updates the payroll registers.

|

•

|

If you do not want to create the manual check, click Clear. |