Performing Slavic 401K Imports

You can upload a retirement plan's database file and import its contents using the Slavic 401K Import form. After a successful import, the process updates employee deferral changes.

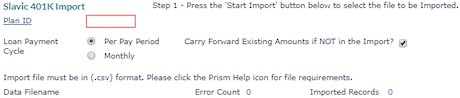

Using the Slavic 401K Import Form

Use the Slavic 401K Import form to import data from an uploaded database file.

This form consists of the following fields:

| Fields |

Description |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Plan ID |

Select the Plan ID. After selecting the ID, the system displays the following message: If no Match eligibility rules are found, the Import defaults the "Eligible For Match" field to Y and uses the effective date for the "Match Starts On Date". If it finds a "Match Starts On Date" less than the effective date, it will set the "Eligible For Match" field to Y and it will use the effective date. |

|||||||||||||||

|

Loan Payment Cycle |

Select one of the following loan payment cycles:

Note: If you select the Monthly loan payment cycle option, observe the following:

|

|||||||||||||||

|

Carry Forward Existing Amounts if NOT in the Import? |

Deselecting this field prevents the system from carrying forward existing amounts during the import process. (Note: This field is selected by default.) |

|||||||||||||||

|

Data Filename |

File you uploaded for import, which must be in .csv format, displays in this field. (The filename displays after completing Step 1 in the Import process.) |

|||||||||||||||

|

Error Count |

Total number of errors after the file imports. Any errors encountered during the process display in the window below this field. |

|||||||||||||||

|

Imported Records |

Number of records imported. |

|||||||||||||||

|

Error Message |

Displays the error occurred during import process. Note: While performing the Slavic 401K import process, the following validations has been added with regard to the prohibit deductions on the Retirement Plans form:

|

Uploading/Importing a Retirement Plan

Clicking Start Import in the Slavic 401K Import panel uploads a retirement plan's database file and import its contents.

Before You Begin

Before you start this process, ensure your database file is set up as follows:

| 1. | Set up an Excel spreadsheet with the following columns: |

| • | Column A: Company ID |

| • | Column B: Social Security Number formatted as a text field without dashes; for example, 111223333 |

| • | Column C: Effective Date in MM/DD/YYYY format |

| • | Column D: Deferral Type specifying D as "Pre-Tax" or R as "After Tax" |

| • | Column E: Contribution Type specifying 1 as "Flat Amount" or 2 as "Percent" |

| • | Column F: Amount specifying Populate if Contribution Type = "1" (no commas) |

| • | Column G: Percent specifying Populate if Contribution Type = "2" |

| 2. | Do not include a header row. |

| 3. | Save the file in .csv format. |

Also, ensure the employee is employed by the client and enrolled in the retirement plan you want to import.

Uploading/Importing a Database File

To upload a database file in .csv format and import its data, do the following in the Slavic 401K Import panel:

| 1. | Click Plan ID and select the appropriate ID. A dialog displays as described in the table above. Click OK to close the dialog. |

| 2. | Click the Loan Payment Cycle option. |

| 3. | Click Start Import to upload a database file, then click Choose File and browse to the file. Click submit. |

| 4. | The data file imports and a confirmation dialog displays. Click Close. |

| 5. | The imported data filename displays in the window, along with any errors encountered. |

| 6. | Click Clear to remove information from the window and repeat the process for another retirement plan, or click Close to close the form. |