Setting General System Parameters

You can set up general parameters on the System Parameters panel.

To set up general system parameters:

| 1. | Complete these fields as required. |

| Field | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Installed Company Name | Business where the software is installed. This name displays at the top of some reports. | ||||||||||||||||||

| Custom Options Suffix | Read-only field used if a system has custom processing installed. | ||||||||||||||||||

| Weeks In Year for Benefit Calculations |

Calculates payroll deduction amounts for employee benefit contributions. Options are 48 or 52 weeks, but you can override this setting for individual clients. This setting has consequences for the calculation of weekly, bi-weekly,semi-monthly, or monthly premiums. Typically, 48 weeks is recommended because the total amount deducted from the client and employee always equals the same monthly premium (and invoice) from the insurance carrier. You can override this at the client level (Client|Change|Benefit Plan Setup). |

||||||||||||||||||

| Minimum Check Amount |

Validation amount used during payroll calculation that flags checks with gross pay amounts less than this value. This dollar amount is per pay period. The recommended amount is 0.00. If the system does a credit check, you will receive a warning message which you can override at the client level. |

||||||||||||||||||

| Maximum Check Amount | Validation amount used during payroll calculation that flags checks with gross pay amounts greater than this value. This dollar amount is per pay period. If the system does a credit check, you will receive a warning message which you can override at the client level. | ||||||||||||||||||

| Tax Calculation Lock (Formerly "Cross-Company Tax Calculation Lock") |

Note: This field was renamed from "Cross-Company Tax Calculation Lock" to "Tax Calculation Lock," and the "No" setting was renamed to "Yes, Lock on Client." However, the functionality of this setting has not changed. Tax calculation locking mechanism used when many employees work for multiple clients. This ensures that calculations such as retirement plan contribution limits are handled correctly. Options are:

|

||||||||||||||||||

| Automatic Mail Code |

An existing delivery code to set automatic mailing capability, when items in a payroll batch are shipped. When a delivery method code is entered in this field, the system sets all payrolls that use the same delivery method to Mailed. Payrolls with different delivery methods must have their status manually set to Mailed. For example, if USPS is entered as a code, the system sets all payrolls sent by US mail to Mailed. Payrolls sent by FedEx must have their status manually set so that the tracking number or other information is logged. Enter ALL to set all payrolls to Mailed status, regardless of the Delivery method. A blank entry means users must manually change the status for every payroll. |

||||||||||||||||||

| Consolidated ACH File Processing Used |

Type of Automated Clearing House (ACH) processing method used. Options include:

|

||||||||||||||||||

| Standalone FSA Reimbursement | Processes FSA reimbursements in standalone batches. If you manage your own FSA, check this box which allows you to do standalone payroll batches for FSA Reimbursements. This is a global setting and will be applied to all clients. | ||||||||||||||||||

| Use Legacy W/C Rate Tables |

Enables legacy Workers’ Compensation Rate Table Maintenance methodology. The system then employs template-based W/C calculations that incorporate policy and rate group designations. You cannot select this option until you have all the codes required to support it. Otherwise, payroll processors cannot initialize payroll batches. |

||||||||||||||||||

| SSN Mask Option | Displays employee social security numbers in PrismHR and Employee Portal (EP). Review these SS masking options before making a selection. Results are the same for PrismHR and Employee Portal (EP) unless otherwise specified.

|

||||||||||||||||||

| New Hire Proper Case Conversion Option |

Converts new employee names and addresses to the proper case when they are hired. Options are:

|

||||||||||||||||||

| Third Party Check Printing Mode |

Configures Third Party Check Printing Mode:

Important! If you do not select an option in the Third Party Check Printing Mode field (that is, this field selection remains "--Select--"), the system processes as though it was in Batch Mode. However, to access third party check processing, you must set this field to Batch Mode. Note: In the backend system, you can manage Third Party Check Printing Mode in mvQuery Third Party Checks Maintenance along with the third party check format, logo, and signature. The setting is always the same setting in both forms. |

||||||||||||||||||

| Void Lockout Year | Prevents pay date voids in that year and all previous years. The system tests Void Lockout Year before it tests Void in Current Period and fails first. | ||||||||||||||||||

| Validate Pay Date Code |

The method that PrismHR uses to validate the pay date. Options include:

|

||||||||||||||||||

| Maximum ACH Batch |

Amount processed in a single ACH transaction batch. Any amount in excess of this is moved to the next batch in the file. |

||||||||||||||||||

| Minimum ACH Window |

Minimum number of days required to process ACH transactions. Any payroll batch with an ACH transaction must be at least this many days in the future. If not, the system will generate paychecks to print instead of ACH transactions. For example, let’s say you put a 0 (zero) in this field. If you run a payroll dated today and the employee has direct deposit, that direct deposit item would go as a direct deposit when you build the file tonight. It would go the bank now, but it will not get to the employee’s account until tomorrow because the day has already passed. However, let’s say you put a 1 (one) in this field. If you run a payroll dated today and the employee has direct deposit, the system will give you a message that says this will be a live check. |

||||||||||||||||||

| ACH Billing Days Offset |

Number of days to offset ACH for invoicing. For example, if the system drafts the ACH the day before the payroll, enter -1 in this field. Note that all ACH files are date-sensitive, so you can post a payroll and create/send the NACHA file several days before the effective date. The funds for both paying and collecting will follow the effective date of each transaction.

If you enter a negative number, you will draw the funds that number of days before the pay date. You can override this setting at the client level. |

||||||||||||||||||

| Days Into Future for ACH Selection |

Number of days into the future for ACH selection after which PrismHR selects ACH transactions to submit to the ACH originating bank. Check with your financial institution to make sure they allow you to send transactions no matter what the date is. Some institutions restrict you to a certain number of days. For example, if you enter 99 in this field, you may build the ACH file up to 99 days ahead of today’s date. However, if you enter 2 in this field, you may only build the ACH file 2 days ahead. This is important for organizations that build ACH files and run payroll on Monday or Tuesday for a Friday pay date. |

||||||||||||||||||

| Suppress Automatic Benefit Adjustment |

Suppresses automatic calculation of benefit adjustments on a global basis. This is not recommended because all Benefit adjustments (which are automatically created by the system) would be suppressed. You can set up overrides at individual benefit or client level, if applicable. |

||||||||||||||||||

| Suppress Arrearage Vouchers |

Suppresses the global creation of arrearage vouchers. This is a zero voucher, created when an employee is active, but they do not get paid. This is a global setting that may be overridden at the client level (Client|Change|Client Controls). Note: The PrismHR Customer Support Team strongly recommends that you do not select the Suppress Arrearage Vouchers option. |

||||||||||||||||||

| Suppress Billing In Initialization/Post | Suppresses the call to the billing routines in the payroll batch calculation and finalization processes. Select this field only if you have consulted with your Implementation Specialist or the PrismHR Customer Support Team. | ||||||||||||||||||

| Suppress TEBA (Accelerated Billing) |

Suppresses accelerated billing of benefit premiums when an employee is terminated. For example, if an employee is terminated mid-month and coverage goes to the end of the month, the system will accelerate the billing to the client and bill the client for any deductions that have not yet been taken from the employee. When you take the deductions from the employee, the client receives a credit. |

||||||||||||||||||

| Suppress Benefits Billing Thru Date |

Suppresses benefits billing. This is used for a short time after a conversion to not bill for benefits already billed on a prior system. |

||||||||||||||||||

| Pay Card Account | Defines a global pay card account for all clients. Note that you can also set this up at the client level (Client | Client Details | Account tab). | ||||||||||||||||||

| Direct Deposit - Force a Balance Account | Forces payment through a direct deposit account instead of a paper paycheck. | ||||||||||||||||||

|

Allow only Entire/Remaining Balance option |

Prevents new hires from selecting a direct deposit method when defining direct deposit settings in Onboarding. Instead, a message displays to indicate that all of the new hire's net pay will be deposited into their direct deposit account. |

||||||||||||||||||

|

Company Name Display for Employee Experience Header |

The client name to display in all employee experience products (Onboarding, Benefits Enrollment, and Employee Portal). The list includes the following options:

|

||||||||||||||||||

|

Disable Marketplace Icon for Service Providers |

Disables the Marketplace link on the PrismHR menu bar for service providers. |

||||||||||||||||||

|

Enable payday notifications |

Enables payday email notifications globally for all clients. |

||||||||||||||||||

|

Enable payroll submission notifications |

Enables payroll submission notifications globally for all clients. (Note: This setting only enables email notifications.) When you select the Enable payroll submission notifications field a confirmation message displays, "This setting will enable payroll submission notifications across all clients. You can override this at the client level under other options. Are you sure you want to enable this feature for all clients?" Select Yes to globally enable the payroll submission notifications. (Selecting No returns you to the form.) |

||||||||||||||||||

|

Enable payroll reminder notifications |

Enables notifications prior to the payroll's cutoff date, if the payroll has not been completed. |

||||||||||||||||||

|

Enable payroll live check calculation warning |

Enables a warning message that displays during payroll calculation to indicate that the system will create a live check. Note: The Enable payroll live check calculation warning field is disabled by default at the system level, but can be overridden at the client level. |

||||||||||||||||||

|

Supplemental Tax Override Rules |

This field has the following drop-down options:

Note: This does not work if custom feature code VSUPPLEMENTAL is enabled in the System Parameters form. |

||||||||||||||||||

|

Tax Adjustment Date Validation |

Use this field to allow your group to restrict future dated tax adjustments. Select one of the following options from the dropdown:

|

||||||||||||||||||

| Custom Feature Codes |

Manages codes developed for use with an installation. (For questions about any custom feature codes, contact the PrismHR Customer Support Team before using them.) Note the following:

|

||||||||||||||||||

| Suppress Garnishment Payments |

If you have garnishments, the system creates a paper check or electronic funds. This setting suppresses garnishment payments by check or EFT. This is a global setting. If it is enabled, no garnishment payments are created. You can override this at the client level (Client|Change|Client Controls). |

||||||||||||||||||

|

Enhanced Garnishment Capping |

By default this field is unchecked. This functionality is beneficial to employers who regularly pay their employees outside of regularly scheduled pay cycles. An example of this would be when you regularly pay an employee both in a regular payroll cycle and additional wages for the same pay period through a manual or special payroll batch.

Also when this field is checked, the system will ensure that the garnishment amount for a State Levy docket does not exceed the flat amount of a given State Levy docket minus the sum of all garnishment deductions made for said docket, during the applicable pay cycle. If an employee has been paid in a previous payroll batch for the same pay period with garnished wages, the State Levy garnishment will only deduct the difference of the total flat amount less the amount garnished on a prior batch for that period. If the State Levy garnishment is reduced to zero, then the system will not calculate garnishment fee for the State Levy as the garnishment for State Levy on current payroll is not deductible. Note: Now when you process a manual or a special payroll batch, and if any employee has a flat amount as a garnishment which is not for child support, then the system will provide a warning for the same indicating the Employee ID and the docket number so that you can review and make adjustments as needed. (This will work only if the Enhanced Garnishment Capping field is checked.) |

||||||||||||||||||

| Days Until Prenote Auto-Activate |

Days after which the system activates pre-noted accounts that were successfully processed through a payroll. This setting works in conjunction with the Prenote on Next Pay Date fields. It is the number of days you want the system to automatically activate the direct deposit after the prenote (test file) was sent to the bank. Normally, the value is between 0 and 7, with 0 indicating no prenote process. |

||||||||||||||||||

| Auto Assign Company ID |

Automatically assigns IDs to new client records. The system default is enabled so that when you create a new client, the system automatically assigns the next available number. |

||||||||||||||||||

| Post Reversals Into Current Period |

Method to post register reversals. Options are:

|

||||||||||||||||||

| Days to Hold Expired Notes |

Specifies the number of days viewed notes are retained by the system. Anything older than this value is deleted. A common value for this field is 30 days. For example, you can put in processing notes for payroll to remind you to take action on an employee. When you run the payroll, this note will display and you can mark the notice as completed. This number indicates the number of days after completion that the note remains in the system. |

||||||||||||||||||

| Independent Contractors Allowed | If enabled, the system processes independent contractors and allows you to enter 1099 employees or contractors. The system also creates 1099 forms. You can override this setting at the client level (Client|Change|Client Other). | ||||||||||||||||||

| Prenote On Next Pay Date |

Enter a code to run a test case of direct deposit information before an EFT occurs. Options include:

Note: When Prenote On Next Pay Date is set to Y - Next Pay Date or B - Next Banking Day, Worksite Managers and Worksite Trusted Advisors cannot change the Direct Deposit option from Prenotification to Deposit Active. |

||||||||||||||||||

| Non-Company ID for A/R Billing | Enable if the accounts receivable is not a valid client ID. This prevents associative processes from trying to link and pull the billed customer’s record. | ||||||||||||||||||

| Default Call-In Time | Standard used for pay groups. This is the cutoff time that payroll is due from your clients. This uses the Central Time Zone and Military Time. | ||||||||||||||||||

| Same Day Check Cut Off |

Prevents posting of same day checks after the specified time. This is used to complete tax processing or daily reporting before the check is posted. If clients are doing same day checks, payroll must be done by this time to process the ACH and positive pay files to send to the bank. This uses the Central Time Zone and Military Time. |

||||||||||||||||||

| Lockout |

Method used to temporarily lock users out of certain types of processing. For example, let’s say you are planning to update Vertex. If users are performing normal tasks, their calculations would be inconsistent because you are updating Vertex while they are processing. You can lock users out and update Vertex to ensure that the calculations are consistent.

|

||||||||||||||||||

| PEO ID | ID for organizations that use the PrismHR Web Services API. (See api-docs.prismhr.com or the SSO User Guide for details.) | ||||||||||||||||||

| EFTPS Batch Filer ID | ID number used for batch filing using the Electronic Federal Tax Payment System (EFTPS). | ||||||||||||||||||

| EFTPS Master PIN | Pin number used for EFTPS filing. | ||||||||||||||||||

| Allow Auto Enroll Suspension? | Suspends auto-enrollments when an employee is hired and does not auto-enroll employees in benefits. You can override this at the client level (Client | Change | Client Benefit). | ||||||||||||||||||

| Auto Term At Payroll Initialization | Enables automatic termination when payroll batches are initialized (calculated). | ||||||||||||||||||

| Enable New Hire First Period Hours |

Enables you to use the New Hire form to enter an employee’s time sheet hours for the first pay period. This is typically used when entering hours for an employee with auto time sheet hours that started in the middle of a pay period. The New Hire field, called First Pay Period Hours, is located in the Pay Details panel. This setting can be overridden at the client level in the Client Details Control tab. |

||||||||||||||||||

|

Independent Contractors |

The fields in the Independent Contractors section indicate how to pay 1099 contractors, so you can easily manage large groups of these employee types:

Note the following about the Independent Contractors section:

|

||||||||||||||||||

| Gender Options |

Provides the following alternatives to traditional gender options:

Add these options to the Gender field on the Employee Details|Personal tab. If these fields are enabled, employees can also select these options in EP. Note: Enabling new gender options can cause issues with benefits and reporting functionality. |

||||||||||||||||||

|

Suppress ACA Eligibility Check |

Note: This option requires enabling the custom feature code STATUS.CHG.ELIG. Disables the enhanced ACA eligibility determination logic. Select this option to ignore part-time employees on the ACA Offered Employees form when determining eligibility for offers of ACA coverage. |

||||||||||||||||||

|

Account Version |

Displays the account's version in read-only format. |

||||||||||||||||||

|

Parent Account |

Displays the account's holding company in read-only format. |

||||||||||||||||||

|

Benefit Adjustment Warning Range |

Enter the minimum and maximum benefit adjustment values to allow without producing warnings. The system generates a warning message when a user tries to manually create (or import) benefit adjustment values outside this range. This specifically affects the Bill Amount, Employee Contribution, and Insurance Cost fields. |

||||||||||||||||||

|

SuperBatch Lookback Period |

Enables you to adjust the lookback period for the SuperBatch process (see the Payroll Processing Guide for details). Any numeric value entered here changes the lookback period the system uses for the Cutoff Date Up To field on the SuperBatch form. Note: This field only displays if you enable the SUPERBATCHLOOKBACK custom feature code. (See Using Custom Feature Codes.) |

||||||||||||||||||

|

Require Manual Payroll Reason |

Enables the payroll Reason field as required on the Payroll Control form for manual payrolls. |

||||||||||||||||||

|

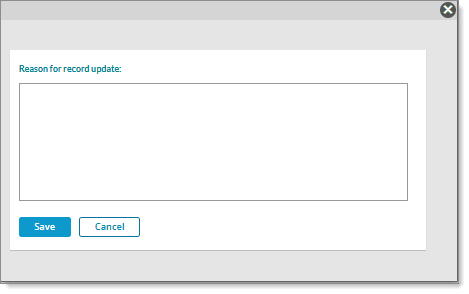

Require change reason on critical forms |

This field will help you to track the reason provided by users when they make changes to any of the following critical forms:

This field is a dropdown and is not mandatory. Select one of the following options:

|

| 2. | Click Save. |