Adding Employees to a Payroll

Use the Add Employees to Payroll form to add employees to the payroll batch. You can only add employees that do not already belong to any of the pay groups scheduled in the payroll; for example, if you want to process a check for an employee in the current batch who belongs to a different pay group. The forms also filters out any employees whose hire date is after the end of the pay period.

When you add an employee, you must specify the pay group to associate with the employee for the payroll batch. PrismHR uses the pay group to assign the period start date, period end date, deduction period, period number, and optional alternate pay period to the employee.

To add employees to a payroll:

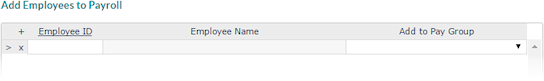

| 1. | Click the Actions menu in the Payroll Control form and then select Add Employees to Payroll. |

| 2. | For each employee: |

| a. | Enter the Employee ID. The Employee Name displays. |

| b. | Select the Pay Group, which must be in the payroll. |

| 3. | Click Accept. You return to the Payroll Control form. |

| 4. | Click Save in the Payroll Control form. |

When to Use This Feature

Some clients with multiple locations, with pay groups defined for each location, have employees who work for more than one location during the pay period.

For example, during the current pay period, Mark works twenty hours at the Main Street location and twenty hours at the South Street location. The system associates an employee with one primary pay group, and Mark is assigned to the Main Street pay group.

| • | Without this feature, Mark would need to be paid for twenty hours within his normally scheduled batch. |

| • | If you use this feature, you can associate Mark with South Street's pay group for the purpose of paying him the hours worked at their location. |

Benefit and Deduction Considerations

When you add an employee to a batch, the employee's payroll voucher is treated as a supplemental pay voucher for deductions calculations, regardless of the type of pay found on the voucher. As such, standard deductions are not deducted. However, deductions that normally would be taken from a supplemental pay voucher—a retirement plan, garnishment, or deduction in arrears—will be deducted.

In the example, Mark's standard benefit deductions would be taken on the payroll voucher paid in his regular pay group batch. If the pay is not sufficient to cover all scheduled benefit deductions, the balance goes into arrears. When the remaining twenty hours are paid in the batch to which Mark was added, PrismHR takes the deduction amounts in arrears on that paycheck.